All Categories

Featured

Table of Contents

Variable annuities have the potential for higher revenues, however there's more risk that you'll lose cash. Beware about putting all your assets into an annuity. Representatives and business should have a Texas insurance policy certificate to lawfully sell annuities in the state. The issue index is an indicator of a company's customer service record.

Annuities offered in Texas must have a 20-day free-look period. Substitute annuities have a 30-day free-look duration.

Whether you'll lose any kind of perk rate of interest or features if you give up your annuity. The ensured rate of interest prices of both your annuity and the one you're considering changing it with.

Make sure any type of representative or business you're taking into consideration getting from is certified and monetarily steady. receiving annuity. To validate the Texas license standing of an agent or company, call our Assistance Line at 800-252-3439. You can likewise make use of the Company Lookup feature to learn a firm's economic rating from an independent score company

There are 3 types of annuities: repaired, variable and indexed. With a dealt with annuity, the insurance policy company assures both the rate of return (the interest price) and the payout to the financier.

Group Annuity Contract

With a deferred fixed annuity, the insurance provider consents to pay you no much less than a defined interest rate as your account is expanding (income annuities). With an immediate set annuityor when you "annuitize" your postponed annuityyou obtain a predetermined fixed amount of money, normally on a regular monthly basis (similar to a pension plan)

While a variable annuity has the advantage of tax-deferred growth, its annual expenses are most likely to be much more than the expenditures of a common common fund. And, unlike a taken care of annuity, variable annuities don't provide any kind of guarantee that you'll gain a return on your financial investment. Instead, there's a risk that you might really shed cash.

Due to the complexity of variable annuities, they're a leading source of financier grievances to FINRA. Prior to getting a variable annuity, meticulously reviewed the annuity's prospectus, and ask the person marketing the annuity to clarify all of the product's features, motorcyclists, prices and limitations. Indexed annuities normally provide a minimum guaranteed interest rate integrated with a passion rate linked to a market index.

Comprehending the features of an indexed annuity can be complex (annuity life insurance). There are numerous indexing methods companies make use of to calculate gains and, as a result of the selection and intricacy of the methods used to credit scores rate of interest, it's challenging to compare one indexed annuity to an additional. Indexed annuities are generally classified as one of the complying with 2 types: EIAs provide an assured minimum rate of interest rate (normally at least 87.5 percent of the premium paid at 1 to 3 percent passion), in addition to an additional rate of interest linked to the efficiency of several market index

5. The S&P 500 Index consists of 500 big cap supplies from leading business in leading industries of the United state economic situation, capturing roughly 80% coverage of U.S. equities. The S&P 500 Index does not include returns proclaimed by any of the business in this Index.

The LSE Group makes no case, forecast, guarantee or representation either as to the results to be obtained from IndexFlex or the suitability of the Index for the objective to which it is being put by New york city Life. Variable annuities are lasting financial products made use of for retired life financial savings. There are costs, costs, restrictions and dangers associated with this policy.

Withdrawals might be subject to normal earnings taxes and if made prior to age 59 may be subject to a 10% Internal revenue service fine tax obligation. This material is general in nature and is being provided for educational purposes only.

The syllabus contain this and various other information about the item and underlying financial investment alternatives. Please check out the programs meticulously before spending. Products and functions are offered where approved. In many jurisdictions, the plan form numbers are as follows (state variants may apply): New York Life IndexFlex Variable AnnuityFP Series (ICC20V-P02 or it may be NC20V-P02).

Are Fixed Annuities Safe

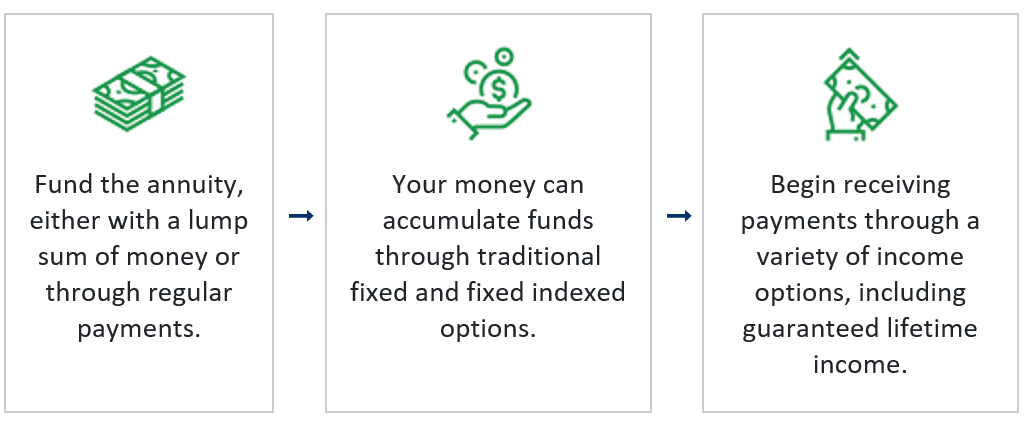

A revenue annuity starts dispersing payments at a future day of your choice. Typically, you make a solitary lump-sum repayment (or a collection of repayments) and wait up until you're all set to start receiving revenue. The longer your money has time to grow, the greater the earnings payments will certainly be. Fixed deferred annuities, also referred to as repaired annuities, offer secure, surefire growth.

The worth of a variable annuity is based on the performance of a hidden portfolio of market investments. what is single premium deferred annuity. Variable annuities have the benefit of giving more selections in the means your cash is spent. This market exposure might be needed if you're searching for the chance to expand your retired life nest egg

This product is for information usage only. It should not be counted on as the basis to purchase a variable, dealt with, or prompt annuity or to execute a retirement method. The info provided here is not written or intended as investment, tax obligation, or legal advice and may not be relied upon for functions of avoiding any government tax penalties.

Tax outcomes and the suitability of any kind of item for any type of details taxpayer might differ, depending upon the certain collection of truths and scenarios. Entities or individuals distributing this details are not authorized to offer tax or lawful guidance. Individuals are motivated to seek particular guidance from their personal tax obligation or legal counsel.

If withdrawals are taken before age 59, a 10% IRS penalty might additionally use. Withdrawals might also undergo a contingent deferred sales cost. Variable annuities and their hidden variable investment alternatives are sold by prospectus just. Investors ought to take into consideration the financial investment purposes, risks, costs, and expenses very carefully before spending.

What Is A Fixed Annuity Account

Dealt with and variable annuities are released by The Guardian Insurance & Annuity Business, Inc. (GIAC). Variable annuities are provided by GIAC, a Delaware firm, and dispersed by Park Opportunity Stocks LLC ().

5 Watch out for taken care of annuities with a minimal surefire passion price of 0%. Watch out for advertisements that show high rate of interest rates.

Some annuities provide a higher assured interest for the first year only. This is called an intro price. The rate of interest decreases afterwards. Make certain to ask what the minimum rate is and the length of time the high rates of interest lasts. There are various means to start obtaining earnings repayments.

Variable Annuity Guarantees

You generally can not take any kind of additional money out. The main reason to get a prompt annuity is to get a normal revenue today in your retirement. Deferred Annuity: You start getting earnings several years later on, when you retire. The major factor to purchase a deferred annuity is to have your cash grow tax-deferred for a while.

This product is for educational or academic objectives only and is not fiduciary investment advice, or a safety and securities, financial investment technique, or insurance coverage item referral. This material does not consider an individual's own goals or situations which should be the basis of any investment choice. Investment items may be subject to market and various other risk aspects.

Table of Contents

Latest Posts

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Investment Choices What Is Fixed Index Annuity Vs Variable Annuity? Features of Smart Investment Choices Why Choosing th

Decoding What Is Variable Annuity Vs Fixed Annuity Key Insights on Variable Vs Fixed Annuity Defining the Right Financial Strategy Pros and Cons of Fixed Vs Variable Annuity Why Pros And Cons Of Fixed

Understanding Fixed Vs Variable Annuity Pros Cons Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Pros and Cons of Fixed Annuity Vs Equity-linked Va

More

Latest Posts